Consolidate talent management with HR software tailored to your company's specific needs.

Our clients love our Service, experience it today too!

What can the pre-payroll system contribute to your company?

Sends information saving time and costs

All concepts approved by the company are compiled for processing in the payroll. Travel expenses, advances, bonuses, etc.

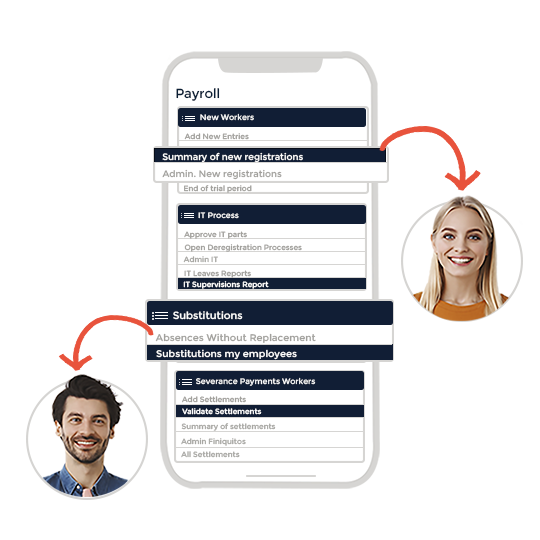

Connects with your outsourced Consultancy

The form is sent to your consultancy or in-house payroll manager to assist them with severance pay, annual and sick leaves, as well as other issues related to job positions.

Receive notifications to stay on top of things

With OpenHR you can report labor incidences such as sick leaves, new employees and termination.

Improve Employee and Manager experience

Demo

Book your demo

Request a free demo with a member of our team to discover the key features of OpenHR that will improve your company's HR management.

-Schedule a time on the calendar

-You will receive a confirmation of your demo

-We will conduct the OpenHR demo with you

Do you have any questions?

We have compiled information to help you solve any questions you may have. If you do not find the answer you are looking for do not hesitate to contact our team.

What is the difference between payroll and pre-payroll?

The difference between payroll and pre-payroll is the time at which they are generated and their purpose within the process of paying salaries to employees.

Payroll refers to the calculation and recording of the wages and salaries of a company's employees for a given period. It is a document that details

the gross remunerations, the corresponding deductions (such as taxes, social security, loans, etc.) and the net amount that each employee

will receive. The payroll is prepared after the pay period has been completed, usually at the end of each month or fortnight.

The pre-payroll, on the other hand, is used as a payroll estimate before the pay period is completed. It is a useful tool for anticipating labour costs and making financial projections.

Pre-payroll is generated before deductions and other final adjustments required to calculate the actual payroll are made. It can be used to obtain an approximation of the payments to be made, verify

the availability of funds or make adjustments before the final payroll is issued.

In summary, the main difference between payroll and pre-payroll is that payroll is the final and detailed record of employees' wages and salaries after the completion of the pay period, while pre-payroll is a preliminary estimate or calculation before the end of the pay period, which can be used to plan or make necessary adjustments

before issuing the final payroll.

Why use pre-payroll in OpenHR?

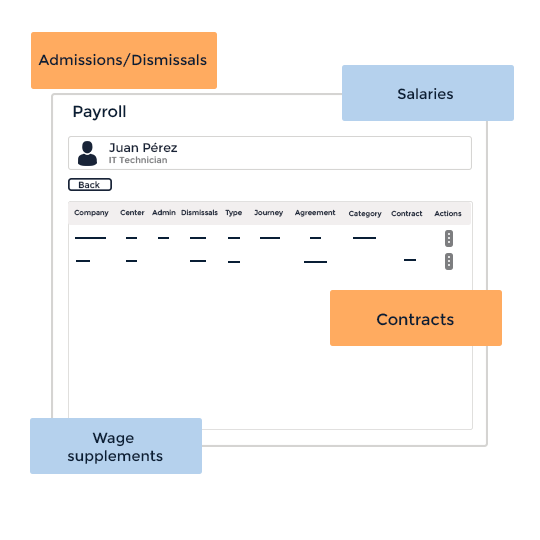

Once gathered all the necessary information in your HR software, you can proceed to the next step, which involves calculating the corresponding payments and deductions to determine your employee's salary.

We have digital tools that can help automate tasks and simplify processes. An example of this is OpenHR, a software specialised in Human Resources management.

This platform provides assistance in calculating payroll, automate registers, collect, and calculate and finally approve the necessary data.

OpenHR helps you communicate with your payroll consultant or manager to make payroll easier for them. In this sense, a human resources software such as OpenHR can provide you with all relevant data for payroll (hours worked, absences, holidays, unpaid leaves, new employees, terminations, task management, etc.).